Eco Tax Guide for Accommodation Owners: Simplified Submission Process

Greetings Accommodation Owners,

Welcome to our Eco Tax Guide, tailored exclusively for owners like you. This guide is your go-to resource, providing insights on where to access crucial information from our reports and simplifying the submission and payment of your ECO on accommodation returns.

Understanding Your Eco Tax Calculation

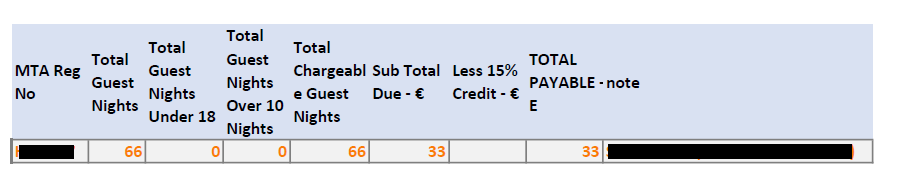

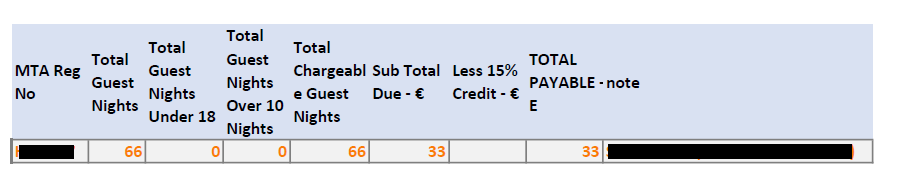

After we meticulously calculate the precise Eco Tax owed based on guest nights, age, and stay duration, ensuring seamless compliance with all regulations, you, the owner, receive detailed reports. These reports break down guest nights, exemptions, and chargeable amounts, leaving no room for ambiguity.

Streamlining the Collection Process

To facilitate a seamless process, we collect the Eco Tax directly from guests during their online booking payment. Once your license information is provided and integrated into our system, guests conveniently pay the Eco Tax as part of their stay transaction. This ensures a smooth and efficient remittance process independent of the monthly rental income.

Monthly Updates for Hassle-Free Compliance

On a monthly basis, we equip you with the requisite information for your Eco Tax submission. As part of the process, it is imperative that you, the owner, submit this information to CFR VAT on a quarterly basis, ensuring a seamless and efficient compliance procedure. Check out a sample of the monthly reports our accounts team sends to landlords.

How to Access and Submit ECO on Accommodation Returns Online

In the modern era, filing your ECO on accommodation return has become easier than ever. You can conveniently submit it online and make payments through Internet Banking or the Government Payment Gateway (GPG). Here are the steps:

Step 1: Access the Online Filing Service

To begin, visit the “How to Register for the ECO Return Submission Service” section on our website. You’ll need your e-ID to log in to the CFR website and submit your ECO on accommodation return.

Step 2: Options for Filing

Choose one of the following options based on your preference:

- File the return yourself (if you are a sole proprietor): make sure to obtain an e-ID by contacting 2122-6628.

- Delegate the filing to your employees (including yourself): fill out the CFR03 form and send it to ictservices.cfr@gov.mt. Download the form here.

- Appoint a tax practitioner for filing through delegation: have your tax practitioner fill out the CFR02 form here.

All representatives filing ECO on accommodation returns must have an e-ID account.

Filing ECO on Accommodation Returns Online: Step by Step

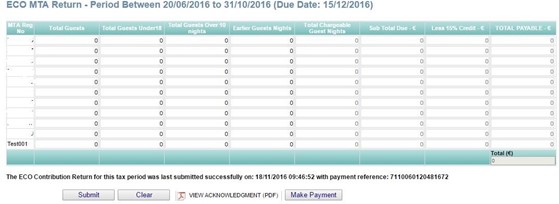

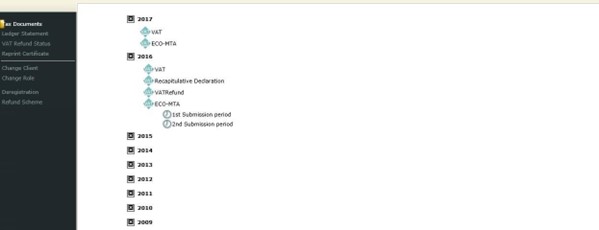

1.Click on the ECO-MTA node and select the appropriate quarter.

2 .Please input the details for each license displayed on the screen, ensuring to include the months relevant to the filing period as outlined in the information provided on our monthly report. Once completed, press the submit button to finalize the return.

(Sample of the monthly reports sent by accounts)

3.After submission, you’ll receive a payment reference number. An email with acknowledgment and the payment reference will be sent, and you can also view it online through the “View Acknowledgement (PDF)” link.

Remember, if you want to delve deeper into the eco tax system, check out our blog: Eco Tax System Compliance Made Easy for Landlords.

We hope this guide makes the process straightforward for you. Happy filing!

Still have questions or need assistance?

Feel free to reach out to our dedicated support team. We’re here to help guide you through any queries related to the Eco Tax process. Your compliance and peace of mind are our top priorities. Contact us.